Convincing performance

The objective of all MIXTA OPTIMA mixed assets is to outperform their respective benchmarks over the long term. Through active management at the level of tactical asset allocation, as well as in the independent selection of the underlying investment vehicles, attractive results have been achieved over the years. The track record is convincing.

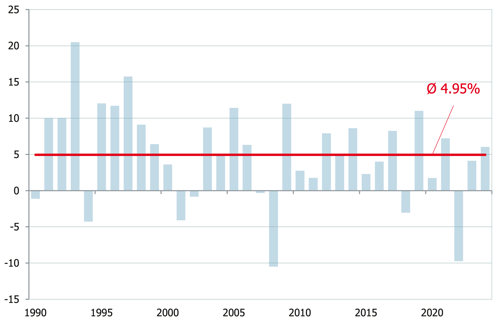

IST MIXTA OPTIMA 25 was launched in April 1990 and has one of the longest track records among its peers. With an annualized performance of 4.95% (Cat. III, as of 31.12.2024), the long-term performance record of IST MIXTA OPTIMA 25 is convincing:

- The fulfillment of the long-term performance targets was generated through active management while adhering to the strategic bandwidths.

- By avoiding a procyclical investment pattern, a risk-adjusted added value independent of market cycles results compared to the benchmark.

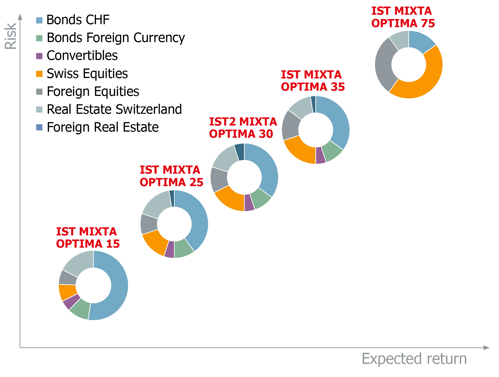

IST MIXTA OPTIMA – Integral total investment solutions

MIXTA OPTIMA are actively managed and broadly diversified investment groups. Depending on the investor's risk capacity, specific mixed assets with different equity ratios are available. This gives our investors access to a wide range of investment opportunities in traditional asset classes, including NAV-valued Swiss real estate.

Our professionally managed total investment solutions are cost-effective and efficient. They are particularly suitable for small and medium-sized pension funds and offer numerous advantages:

- Minimization of the personnel and administrative expenses of a pension fund

- Broadly diversified investments in traditional asset classes, substantial share in NAV-valued real estate investments in Switzerland

- Anti-cyclical investment behavior through standard quotas and associated bandwidths

- Proven best-in-class selection process or core/satellite approach

- MIXTA OPTIMA demonstrate the quality of our manager selection and its implementation in practice

- Attractive fee structure

- Sustainable MSCI ESG Rating: AA

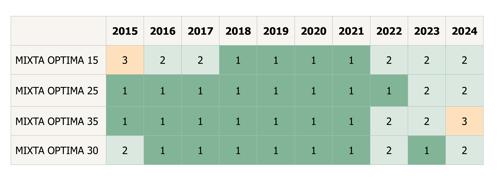

Excellent performance in KGAST comparison

The performance of the individual strategies from the IST MIXTA OPTIMA family does not have to shy away from the competitive comparison. In the long-term KGAST comparison, the investment groups are predominantly in the 1st or 2nd quartile and illustrate their qualities as long-term oriented, disciplined investing mixed assets.

The following table reflects the quartile ranking of the individual MIXTA OPTIMA strategies in the KGAST comparison rolling over 5 years (data as of 31.12.2023). The colors additionally reflect the respective quartile placement.

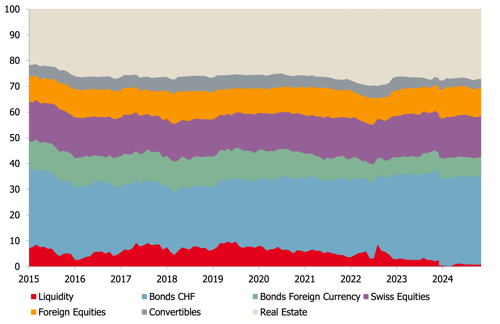

Active management pays off

The growing focus on asset management costs has led to the triumph of passive investment management over the past two decades. However, this raises the question of whether one wants to be at the mercy of market indices - even in times of falling prices. A targeted risk reduction within the permitted investment guidelines can prove to be a decisive advantage, especially in difficult market phases.

It is not the wind that determines the direction of travel, but the sails. We have dedicated ourselves to this principle in our entire IST MIXTA OPTIMA family. With this approach, the weighting of the individual LOB/LPP asset classes in IST MIXTA OPTIMA 25 has been continuously adjusted to market conditions.

- The active weighting of certain asset classes is based on the attractiveness of their risk premiums. For example, CHF bonds were significantly underweighted during the entire zero interest rate phase in favor of yield-oriented NAV-valued Swiss real estate.

- The tactical implementation complements the investment strategy and takes into account the current stock market environment. It is opportunistic and has a shorter investment horizon.